1 min. read

·

Already 900+ portfolios built with 300,000+ carbon credits

Access to the rapidly growing carbon credit market

If you want to benefit from your investment in carbon credits, buy them now. Ecommit offers you access to the carbon credit market and provides a carbon credit portfolio at a fixed price. In line with price increase on the global market, this price is adjusted regularly. You can arrange your purchase within five minutes and immediately have full control over your carbon credits.

As of January 2026: €22.50 per credit, excluding VAT.

Buying carbon credits: easy to arrange

1. Decide how much you want to invest: choose the amount you want to invest or the number of carbon credits you want to buy.

2. Receive your carbon credits immediately: right after your payment, your carbon credits will be delivered and you will gain access to your dashboard.

3. Manage your carbon credits entirely according to your wishes: decide at any time whether you want to retire them or offer them for sale.

Complete control over your carbon credits in your dashboard

The ecommit dashboard gives you complete control over your carbon credits. The credits are registered in your name, giving you 100% control over what you want to do with them. Your dashboard provides details about the projects, allows you to generate CSRD reports, and offers you the option to sell or retire carbon credits. You set the course.

Manage

Manage your credits in your dashboard

Decide

Hold, sell or retire

Profit

Get the most out of your assets

Your advantage

-Access to the carbon credit market

-Easy buying and selling

-Insight into market data

-Manage carbon credits in your dashboard

-Fully accessible in public registers

Interested? Make an appointment now

Increasing demand for carbon credits leads to price increase

Currently, the average price of a carbon credit is below $25. Due to increasing demand combined with a limited supply of high-quality climate projects, the price is likely to rise sharply. EY has analyzed the VCM and expects prices to range from $75 to $125 in 2035 and from $125 to $170 in 2050.*

*Source: EY, 2024, p. 38. Essential and still evolving: The global voluntary carbon market outlook 2024

Why are carbon credits

becoming scarce?

Carbon credits are not available in unlimited quantities. International agreements such as CORSIA (mandatory carbon removal in international aviation), Article 6 of the Paris Climate Agreement, and the EU climate target for 2040 are driving up demand for carbon credits. At the same time, many projects do not meet the stricter integrity and verification standards. Supply is therefore limited, while demand from companies and countries is growing rapidly.

EU climate target and carbon credits

The European Union has set the following climate target for 2040: a net 90% reduction in carbon emissions, 5% of which is to be achieved through carbon credits. In concrete terms, this means that the EU must reduce carbon emissions by 85% compared to 1990 levels and may use carbon credits for 5%. The carbon credits may be used from 2031 onwards.

Why purchase carbon credits?

Carbon credits are a scarce, tradable commodity - similar to stocks, real estate, and cryptocurrency. Demand is growing rapidly, while supply must meet increasingly stringent requirements and remains limited. This makes carbon credits increasingly sought after and therefore more valuable.

Follow the lead of the major players in the market

Multinationals such as Microsoft, Google, Amazon, and JPMorganChase have been active in the carbon credit market for years. They lock in millions of tonnes of carbon credits, building strategic portfolios to hedge against future price increases. Ecommit gives your company or personal holding access to the carbon credit market, while you retain complete control. You decide how much and when to buy, hold, and offer for sale. Everything in one place and under your control.

“With ecommit, any company can approach and manage carbon credits as an asset, making this emerging market accessible to everyone.”

Joe Sykes

co-founder ecommit

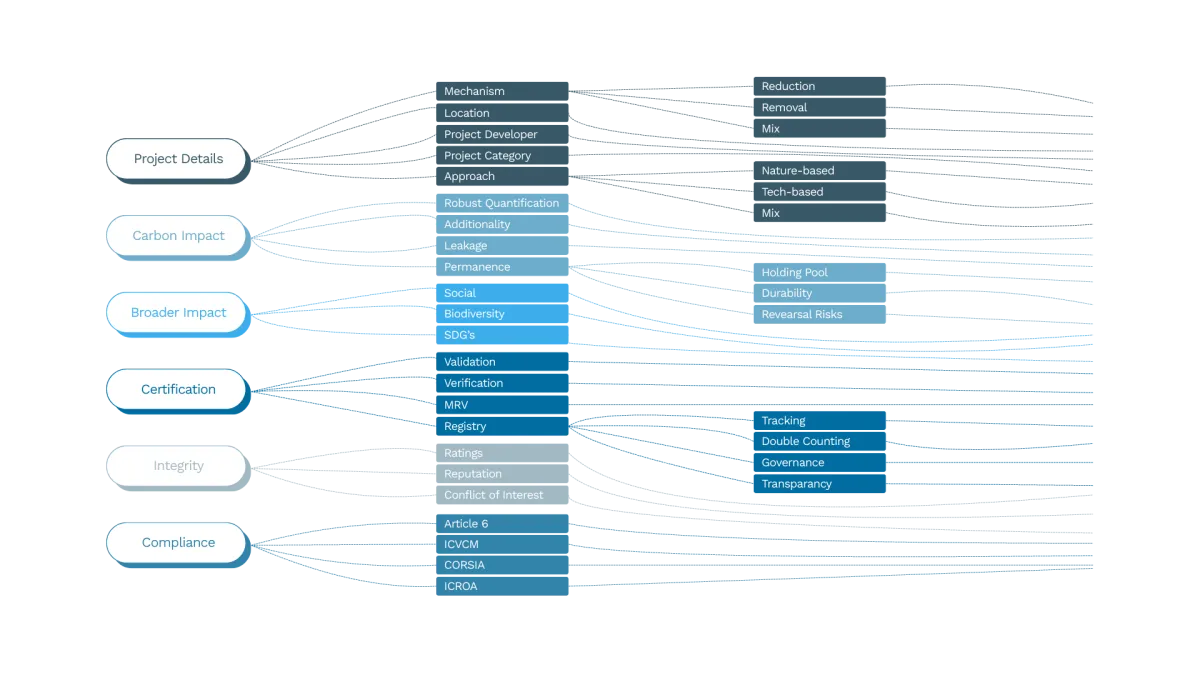

"Our due diligence team assesses carbon credits on more than four hundred data points: from price, liquidity, and compliance to human rights, reputation, and social impact. Only a small proportion of the projects we analyze meet our high standards."

Hester van Dord

COO ecommit

“What’s in it for me? I think this is a perfectly reasonable question for every entrepreneur to ask. Our answer is: a lot. By entering the carbon credit market early on, your company can gain a genuine advantage. And it ensures that capital flows to climate projects. A business model for climate action with impact.”

Verena Jongepier

co-founder & CEO ecommit

What can you do with carbon credits?

Carbon credits are scarce and are becoming increasingly valuable. There are various ways in which you can use them. You can purchase them now and hold onto them to sell them later at a higher price. You can also retire them immediately after purchase to offset your (company) emissions. Or you can purchase carbon credits now to use them in your company at a later date. Finally, you could also consider passing on a sustainability fee to your customers.

Carbon credits for every strategy

Sustainability first

Buying and retiring carbon credits every year to (partially) offset your emissions

Future use

Buying carbon credits for multiple years and retire them as needed

Financial benefit

Buying and holding carbon credits to resell them when prices rise

We assess every carbon credit

To guarantee the quality of our carbon credit portfolios, we conduct thorough research into each project and the associated carbon credits. We check the methodology, location, registration, and all other fundamental documentation for each project. If a project does not meet one of our more than 400 selection criteria, we will not proceed with the purchase of carbon credits. This ensures that only high-quality projects are included in our offering.

This is what a carbon credit portfolio looks like

An ecommit portfolio always consists of a varied package. We select projects from different locations (country and/or region) and from different registers. We also look at the nature of the project. We create a mix of different project types, such as: Blue Carbon, Afforestation, Reforestation and Revegetation, Agroforestry, Biochar, Enhanced Weathering, Improved Forestry Management, Landfill Gas Capture & Utilisation, Waste Handling and Disposal, and Direct Air Capture and Storage. We always ensure careful diversification so that you are optimally positioned. All credits in the portfolios are either in line with Article 6 or ICVCM-approved.

See how other corporates made the switch

BusiNext

I have purchased a stock of carbon credits, enabling me to offer my customers more sustainable transport. With every bus rental, we give customers the option to offset the emissions from their transport.

John Hage

Managing Director

CarCollect

A broad sustainability strategy is at the core of our fast-growing business and carbon offsetting is a key part of it. We offset the total estimated emissions of our company, including emissions of staff and data storage.

Lev van der Eng, CCO

Ricoh Document Center Zuidwest-Nederland

Nowadays, it is absolutely essential to work in a responsible manner. I notice this in my contacts with business relations and certainly also in tenders. We are already purchasing carbon credits for the coming years and decide for ourselves when and where we use them within our company.

Bas van Keulen

Director-owner

How we work

Analysis: we continuously analyze the market and select high-quality, certified climate projects based on our comprehensive risk assessment.

Purchasing: we purchase large quantities of carbon credits from projects that score positively on all points in our risk assessment, thereby creating economies of scale.

Sales: we compile a carbon credit portfolio and offer it at a fixed price that companies and entrepreneurs can purchase.

Price and service: portfolios can be purchased from €100 (excl. VAT). For purchases above €100,000 (excl. VAT), we provide a premium portfolio that is fully tailored to your needs.

Frequently asked questions about carbon credits for future use

You can use (retire) the carbon credits you purchase now at any time. You can also hold on to the carbon credits you purchase and sell them later at a higher price.

Reducing emissions is always a good thing. However, there are also emissions that you cannot (yet) reduce. By purchasing carbon credits, you are also taking responsibility for these emissions. Be aware that carbon credits are not available in unlimited quantities: mandatory carbon removal in international aviation (CORSIA), Article 6 of the Paris Climate Agreement, and the EU climate target for 2040 are driving up demand, while supply remains limited because many projects do not meet the stricter integrity and verification standards. Therefore, purchase carbon credits in good time, even if you are working on reducing emissions.

To compile a carbon credit portfolio, we create a mix of projects from different locations (country and/or region), from different registries, and different project types in order to spread any risks as much as possible. For each project, we check the methodology, location, registration, and all other fundamental documentation.

For your tailored carbon credit portfolio we take into account preferences such as the type of project, country, specific SDGs or other aspects you want to see reflected in your portfolio.

Carbon credits are the perfect means to support any type of business strategy. Whether your ambitions are to take climate action, comply with the CSRD, make a profit, market your steps towards net zero or a combination of these, carbon credits are the way to invest in sustainability while fulfilling your company goals.

When you purchase carbon credits from ecommit, we register the carbon credits in your company's name. The moment you purchase carbon credits does not have to be the same moment you use them. The act of actually using your carbon credits is called retiring. When you retire your carbon credits (now or in the future), the carbon removal is attributed to your company. Once retired, carbon credits can no longer be used or sold.

At ecommit it is possible in some cases to purchase forwards. These are carbon credits that have yet to be issued from a project that has already been validated. Thanks to your purchase, money goes directly to the project. In this way, you take on part of the entrepreneurial risk of the project developer. Forwards are often attractive in terms of price.

Want to benefit from your investment in carbon credits?

Stay informed with our blogs

In our blogs, you will find everything you need to know about carbon offsetting. We keep up with legislation, provide the latest news, summarize research findings, and share whitepapers.

2 min. read

·2 min. read

·Questions about addressing carbon emissions?

Do you have a question or do you want more information? Contact us for a free consultation.